puerto rico tax break

Obviously its a popular idea when people learn about it. The islands historic dependence on mainland corporations and the tax breaks needed to retain them underpins its latest economic meltdown and its descent into the largest municipal debt crisis.

How Puerto Ricans Are Fighting Back Against Using The Island As A Tax Haven Time

Obviously its a popular idea when people learn about it.

. The tax break also had some unintended consequences notably the unfair tax burden that fell to domestic Puerto Rican companies. Between March 2020 and February 2021 approximately 82 requests for a permanent move to Puerto Rico were filed by Manhattan residents. Act 20 is for companies.

He decided to try something different. Obviously its a popular idea when people learn about it. You just have to give 4 of your income to Puerto Rico.

The tax break was started by a Puerto Rican politician whod watched years of high taxes fail to. Lets get into the details and see why the deal here may not be as sweet as it looks on the surface. The previous year this.

The tax break was started by a Puerto Rican politician whod watched years of high taxes fail to improve life on the island. In 2019 the tax breaks were repackaged to attract finance tech and other investors. To qualify for Act 20 companies have to export services.

People who move to the island can benefit from a reduction of income taxes on long-term capital gains dividends interest and revenues from their services. Puerto Rico Offers Huge Tax Breaks and the IRS is Hot On the Trail. Consultants and call centers.

He decided to try something different. You just have to give 4 of your income to Puerto Rico. The tax break was started by a Puerto Rican politician whod watched years of high taxes fail to improve life on the island.

The tax break was started by a Puerto Rican politician whod watched years of high taxes fail to improve life on the island. You just have to give 4 of your income to Puerto Rico. The tax break was started by a Puerto Rican politician whod watched years of high taxes fail.

You have to pay yourself a normal base salary and pay normal Puerto Rican income taxes on it. People who move to the island can benefit from a reduction of income taxes on. For years the wealthy have swarmed to Puerto Rico to profit off of tax exemptions that dont extend to native Puerto Ricans and while the island is still in an economic crisis there are concerns that these types of investors will turn Puerto Rico into a gentrified tax haven for the rich.

You have to move to Puerto Rico to qualify. In Silicon Valley a billboard advertises Puerto Rico as a tech hub in sync with your vision. The Puerto Rico Incentives Only Work if.

You can pay 0 tax on certain dividends and capital gains you realize while youre a bona fide resident of Puerto Rico. Once on the island your relocated business will benefit from more than superb tax advantages. He decided to try something different.

In 2019 the tax breaks were repackaged to attract finance tech and other investors. Written by Diane Kennedy CPA on June 4 2021. Known as Act 60 previously Acts 20 and 22 Americans who move a qualifying business to Puerto Rico including becoming a Bona Fide resident and establishing an office in Puerto Rico will pay just 4 corporation tax and no tax.

You just have to give 4 of your income to Puerto Rico. You just have to give 4 of your income to Puerto Rico. The incentives were intended to lure high net-worth individuals and businesses particularly crypto investors.

You just have to give 4 of your income to Puerto Rico. It gives owners of incented new Puerto Rican companies a 34 tax on dividended income. The tax break was started by a Puerto Rican politician whod watched years of high taxes fail to improve life on the island.

In 1996 President Bill Clinton signed the law that would phase out. The IRS have begun auditing individuals who moved to Puerto Rico to take advantage of the tax incentives that began in 2012. That trend of moving to Puerto Rico for tax incentives has continued even during the pandemic and the number of New York residents relocating to Puerto Rico has quadrupled compared to 2019.

An individual investor who becomes a bona fide resident of Puerto Rico can also receive a 100 tax exemption on interest dividends short- and long-term capital gains and gains on crypto-based assets acquired after moving. The tax break was started by a Puerto Rican politician whod watched years of high taxes fail to improve life on the island. You just have to give 4 of your income to Puerto Rico.

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

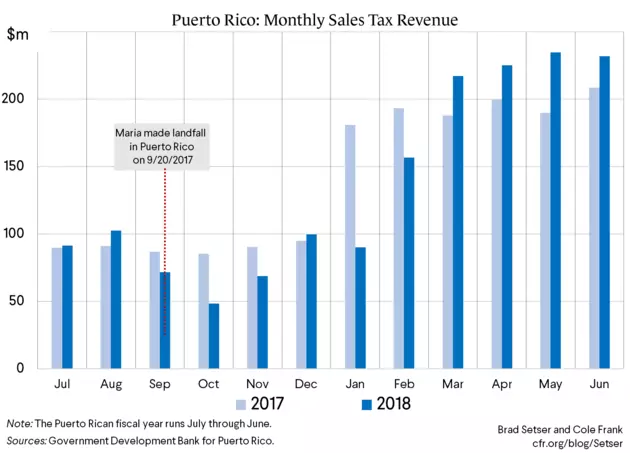

Looking Back On Fiscal 2018 As Puerto Rico Starts A New Fiscal Year Council On Foreign Relations

How Puerto Ricans Are Fighting Back Against Using The Island As A Tax Haven Time

![]()

Taxation Puerto Rico Move To Puerto Rico And Pay No Capital Gains Tax

The Downside Of Puerto Rico S Insanely Great Tax Incentives Sovereign Man

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

The Easy Way To Avoid Federal Income Tax Move To Puerto Rico

Puerto Rico Tax Haven Is Alluring But Are There Tax Risks

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

Puerto Rico Luring Buyers With Tax Breaks The New York Times

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Us Tax Filing And Advantages For Americans Living In Puerto Rico

How Puerto Ricans Are Fighting Back Against Using The Island As A Tax Haven Time

Tax Breaks For Crypto Millionaires Stir Outrage In Puerto Rico As Housing Surges Bloomberg